Money

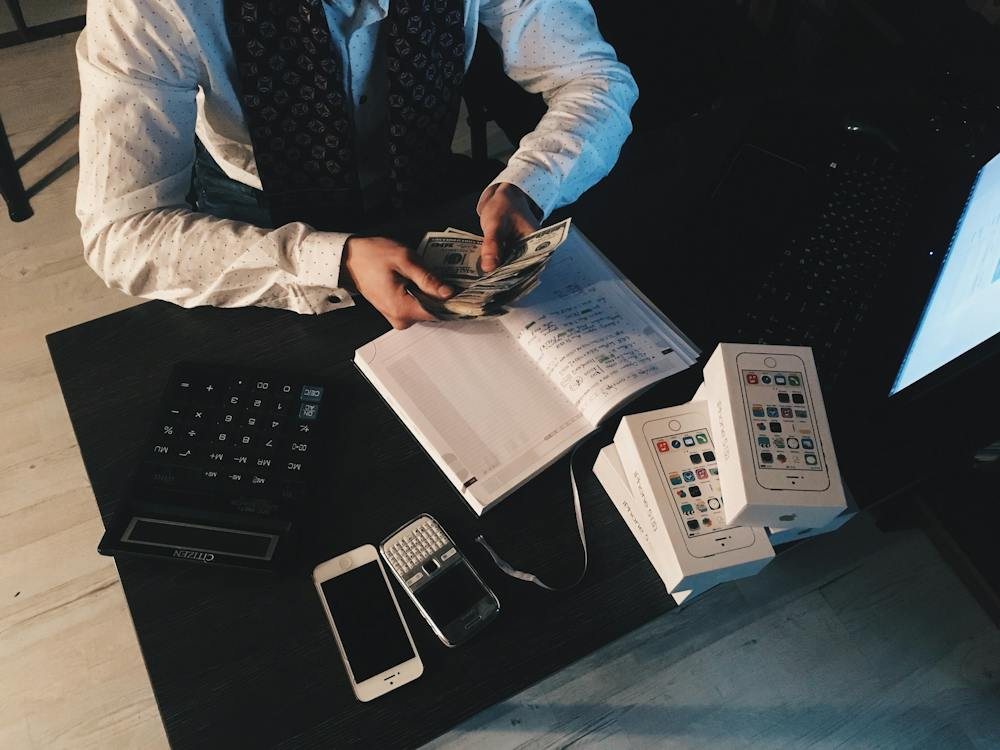

Financial Blunders People Make when Hiring Contractors

CLICK HERE to read the rest of this ARTICLE. This post was originally published on another website.

Money

States Where You Can Go to Jail for Debt

CLICK HERE to read the rest of this ARTICLE. This post was originally published on another website.

Money

Investing in Curb Appeal: How Garage Doors Can Boost Home Value

CLICK HERE to read the rest of this ARTICLE. This post was originally published on another website.

Money

Why Aggravation Is A Valuable Business Tool

CLICK HERE to read the rest of this ARTICLE. This post was originally published on another website.

-

Politics2 years ago

Politics2 years agoTaylor Swift Holds Her Pen Like An Absolute Psycho

-

Politics1 year ago

Politics1 year agoThe U.S. Left Has Become So Authoritarian, Even This North Korean Refugee Is Concerned

-

Health1 year ago

Health1 year agoHow to do a Kettlebell glute workout

-

Politics1 year ago

Politics1 year agoArrest In Idaho Murders Is A Reminder That Your DNA Is Not Private Or Safe

-

Politics2 years ago

Politics2 years agoParents UPSET With School Board Over Drag Show

-

Politics1 year ago

Politics1 year agoCBP Figures Show Highest Monthly Total Of Illegal Crossings EVER Recorded

-

Entertainment2 years ago

Entertainment2 years agoHalloween Ends Official Trailer 2022

-

Money1 year ago

How to get started with online gambling and restaurants marketing